This week, we review an ETR Insights panel where community members discussed the work they are doing with advanced analytics use cases, the vendors they are leveraging, and the technical challenges they encounter as they pursue these projects. The full summary (available on the ETR research platform) is packed with evaluation and commentary on the leading data warehousing and analytics vendors directly from our IT decision maker community.

Many organizations have matured in their data and analytics journeys to a point where advanced analytics use cases have become achievable. Enterprise-scale artificial intelligence and machine learning projects are becoming more commonplace, as are Internet of Things (IoT) initiatives, real-time streaming analytics, and knowledge graphs. Often, these more advanced use cases do not come into play in an organization until after a data management strategy is in place, data governance policies are refined, and use cases like self-service business intelligence and enterprise reporting are well-established. Data lakes and so-called data lakehouses – which combine the best features from data warehousing and data lakes – are increasingly common data management paradigms for organizations venturing towards advanced use cases.

The ETR Insights team assembled a panel of ETR Community members to discuss the work they are doing on these fronts and to get a sense of the kinds of vendors and technical challenges they encounter as they pursue these projects. The panelists represent a variety of industries, and their many advanced analytics use cases were cutting-edge, inventive, and potentially transformative to their businesses. Our panelists included a VP and Chief Data Architect for a large consumer packaged goods company, a data scientist from a large financial institution, a senior manager at a midsized fintech firm, and a founder and digital transformation executive from a small business services enterprise.

Panelists pointed to the big three public cloud platforms – Microsoft Azure, AWS, and Google Cloud Platform – as leading presences in the pursuit of advanced analytics. Each panelist said their organization relies on one or more of these vendors as a backbone of broader data architecture, though they often find themselves supplementing these frameworks with other proprietary and open-source tools to achieve specific outcomes and satisfy use case requirements. For example, the digital transformation executive from a small business services firm pointed out that he architected a largely Microsoft solution for one client but chose Snowflake rather than Synapse to support the implementation of ThoughtSpot, because Snowflake was both faster, prevented total vendor lock-in with Microsoft, and “naturally fits.” Another panelist pointed out the need to marry Google’s image analytics capabilities with open-source tools like Python and TensorFlow to support the analysis and modeling they needed.

Databricks received praise from two of the panelists for its ability to “shine” when handling heavy processing demands and unstructured data with ease, and data lakehouse designs – something Databricks markets itself as providing – were also core to panelists’ graph database pursuits. Panelists emphasized the importance of good data management hygiene as well, with data catalog vendor Alation mentioned by two panelists and the need for good people-and-process approaches to data governance being paramount. Reading between the lines, it is clear that rolling out IoT initiatives has proven tricky for all of the panelists, referred to twice as being “a long journey” that unfolded over time. The difficulties cited were keeping firmware updated and secured on edge devices, challenges with handling streaming data and stitching together multiple tools to get projects accomplished. Apache Kafka, AWS Kinesis, Azure Event Hub, Google Pub/Sub, and Confluent were all mentioned together when panelists discussed IoT, with most having done proofs-of-concept with several IoT tools on their journeys.

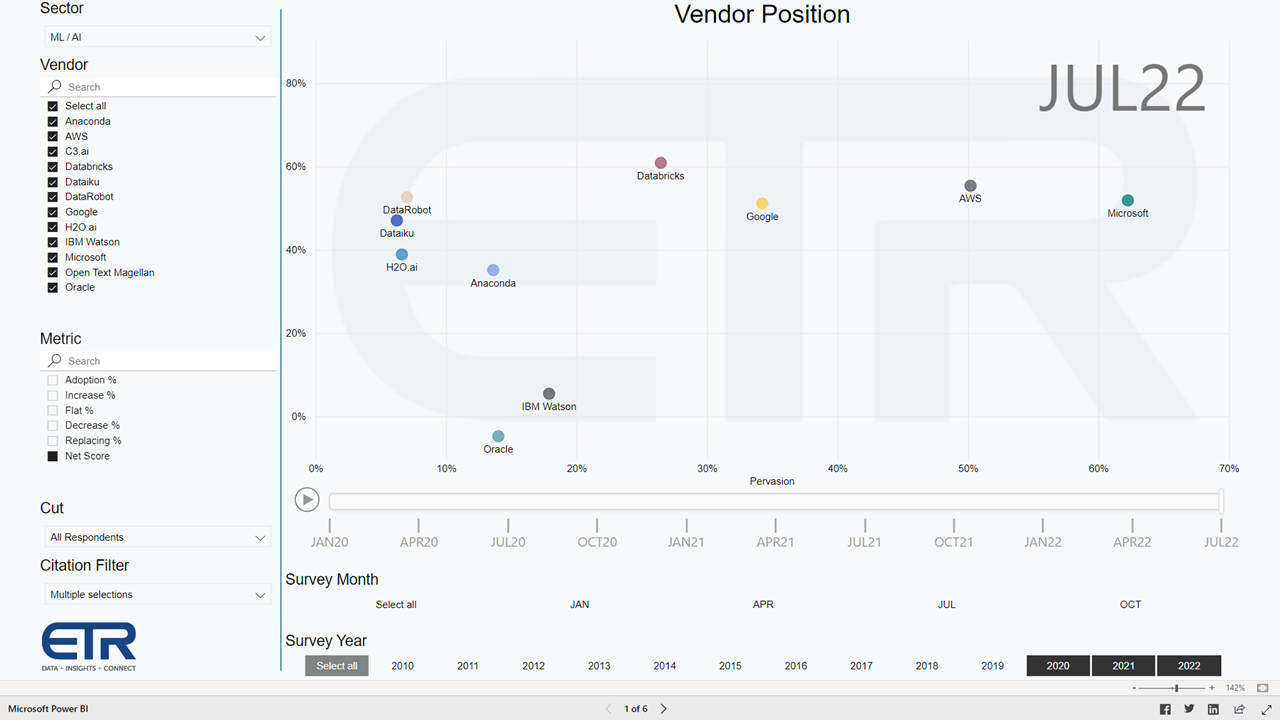

ETR Data: ETR’s July 2022 Technology Spending Intentions Survey (TSIS) shows Microsoft and AWS in the lead relative to its ML/AI sector peers, standing at a 55% and 52% Net Score, respectively, which has declined for both cloud giants as compared to prior survey levels. Switching to our Pervasion metric, which measures citation growth among our survey sample, Microsoft holds a commanding lead over AWS at ~63% vs. ~50% (see Figure 1 below). Google also holds a high Net Score at 51% but it's Databricks that leads the entire sector with an elevated Net Score of 61%. Both vendors trail AWS and Microsoft in Pervasion by a wide margin.

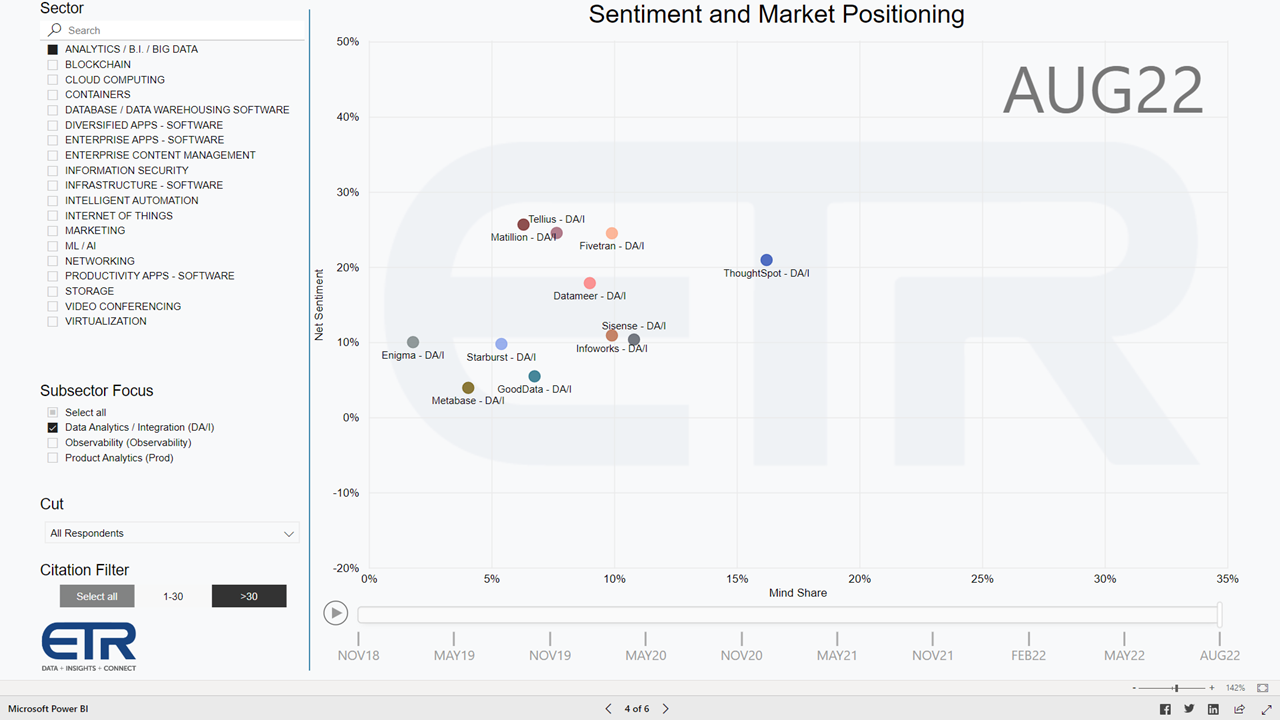

Taking a sneak peek into ETR’s August 2022 Emerging Technology Survey (ETS), which is currently live in the field, we see that ThoughtSpot has fallen to 4th in Net Sentiment position, relinquishing its lead from the recent MAY22 ETS. On a smaller citation base, as the survey is still open and new citations are being tabulated daily, Matillion, Tellius, and Fivetran all hold higher Net Sentiment scores at the moment. However, ThoughtSpot still leads in Mind Share (see Figure 2 below).

For direct quotes and highlighted excerpts from this panel, please see the full Transcript, Summary, and Replay from this ETR Insights Panel where the following vendors were discussed: Alation; Amazon (AWS IoT; Kinesis); Anaconda; Apache (Kafka); Confluent; Databricks; Datadog; Dataiku; DataRobot; Domino; Google (Cloud Vision API, Pub/Sub); H2O.ai; Hugging Face; IBM; Jupyter Notebook; Labelbox; Microsoft (Azure Event Hub, Azure IoT; Power BI, Azure Synapse); Neo4j; Python; Salesforce (Tableau); Snowflake; Splunk; TensorFlow; ThoughtSpot; Timbr.ai; and UiPath

To check out the entire breadth of ETR's Research, activate your free trial.

Enterprise Technology Research (ETR) is a technology market research firm that leverages proprietary data from our targeted IT decision maker (ITDM) community to bring you actionable insights about spending intentions and industry trends. Since 2010, we have worked diligently at achieving one goal: eliminating the need for opinions in enterprise research, which are often formed from incomplete, biased, and statistically insignificant data. Our community of ITDMs represents $1+ trillion in annual IT spend and is positioned to provide best-in-class customer/evaluator perspectives. ETR’s proprietary data and insights from this community empower institutional investors, technology companies, and ITDMs to navigate the complex enterprise technology landscape amid an expanding marketplace. Discover what ETR can do for you at www.etr.ai