ETR recently ran another survey iteration to assess the possible impact of strong emotions in our first CrowdStrike outage survey, repeating all five questions from one month ago. On top of this, we asked new inquiries about the past few weeks, including alternative vendors evaluated and compensation for operational impacts. Like our flash survey from July, nearly three-quarters (73%) of respondents are from large organizations, including a quarter (25%) from Global 2000 firms. Of 100 total respondents (roughly 2/3 are repeat respondents from July), 98 cited impacts from the failure. All but one are still using the Falcon platform, which is unsurprising given the complexity, time, and cost involved with replacing an endpoint security vendor.

Key Takeaways:

• Negative sentiment remains high one month following the IT outage, with over half of IT decision makers in this survey claiming a very significant impact on business operations

• Two out of five ITDMs have evaluated other security vendors in the past month, led by Microsoft (Defender) and followed by platform companies SentinelOne, Fortinet, and Palo Alto Networks

• Over one-third of ITDMs stated they are more hesitant to consolidate their security stack following this incident, but over three-quarters did not expect an impact on the adoption process

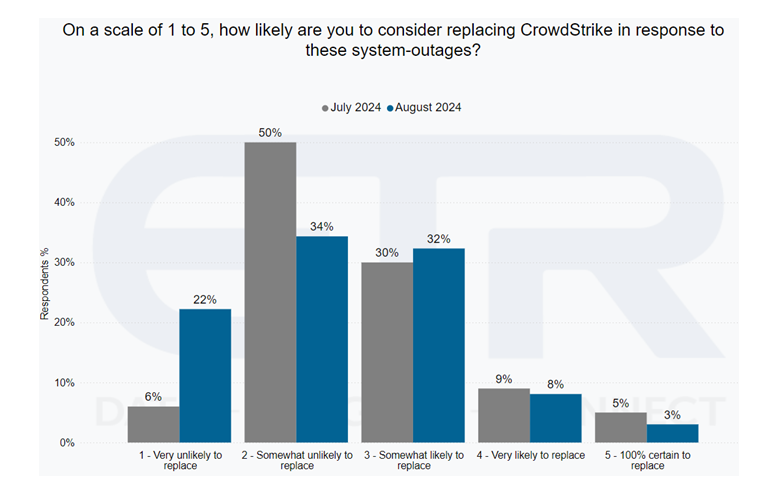

• Compared to one month ago, the total number of citations for Somewhat Likely, Very Likely, and Certain to Replace (43% combined) remained roughly the same

Similar Views Compared to the Initial July Survey

The distribution of perceptions around the difficulty of replacing CrowdStrike was similar to July, while noting a small 5-point shift from ‘Somewhat Easy’ to ‘Very Difficult’:

Negative attitudes around replacement intentions, including Somewhat Likely, Very Likely, and Certain to Replace (43% combined) remained roughly the same in aggregate, while there was a more positive shift from ‘Somewhat Unlikely to Replace’ (-16 points) toward ‘Very Unlikely to Replace’ (+16 points) over the past month.

Considering this in the context of CrowdStrike’s 98% historical gross retention rate, the combined 11% of respondents pointing to Very Likely or Certain plans to churn appears elevated going into contract renewals:

40% of respondents indicated that their organizations had evaluated alternative vendors in the past month, although seventeen had planned to do so prior to the outage. This implies that nearly a quarter (23%) of customers in this sample began to do so as a direct consequence of the outage.

This article only covers 2 of the 12 questions fielded by CrowdStrike customers in our community. If you want to see the full survey results and findings report, including which vendors are considered the best alternatives, you can view that here or request the full report in the sidebar.

Enterprise Technology Research (ETR) is a technology market research firm that leverages proprietary data from our targeted IT decision maker (ITDM) community to provide actionable insights about spending intentions and industry trends. Since 2010, we have worked diligently at achieving one goal: eliminating the need for opinions in enterprise research, which are often formed from incomplete, biased, and statistically insignificant data. Our community of ITDMs represents $1+ trillion in annual IT spend and is positioned to provide best-in-class customer/evaluator perspectives. ETR’s proprietary data and insights from this community empower institutional investors, technology companies, and ITDMs to navigate the complex enterprise technology landscape amid an expanding marketplace. Discover what ETR can do for you at www.etr.ai

Get Free Report

Fill out the form to receive a copy of "Crowdstrike Follow-Up Survey" sent directly to your inbox.