More than 1,550 IT decision makers have already participated in ETR's April 2023 Technology Spending Intentions Survey (TSIS). ETR's Research Team has published an Early Takeaways report, leveraging preliminary data to examine sectors with improving/declining 2023 spending intent, as well as inflections captured at the vendor level. Read last week's part one of the report here, finish up with part two in this article below, or view the full report on the ETR platform. If you're an ETR member, you can start a free trial and gain access to our industry-leading research today.

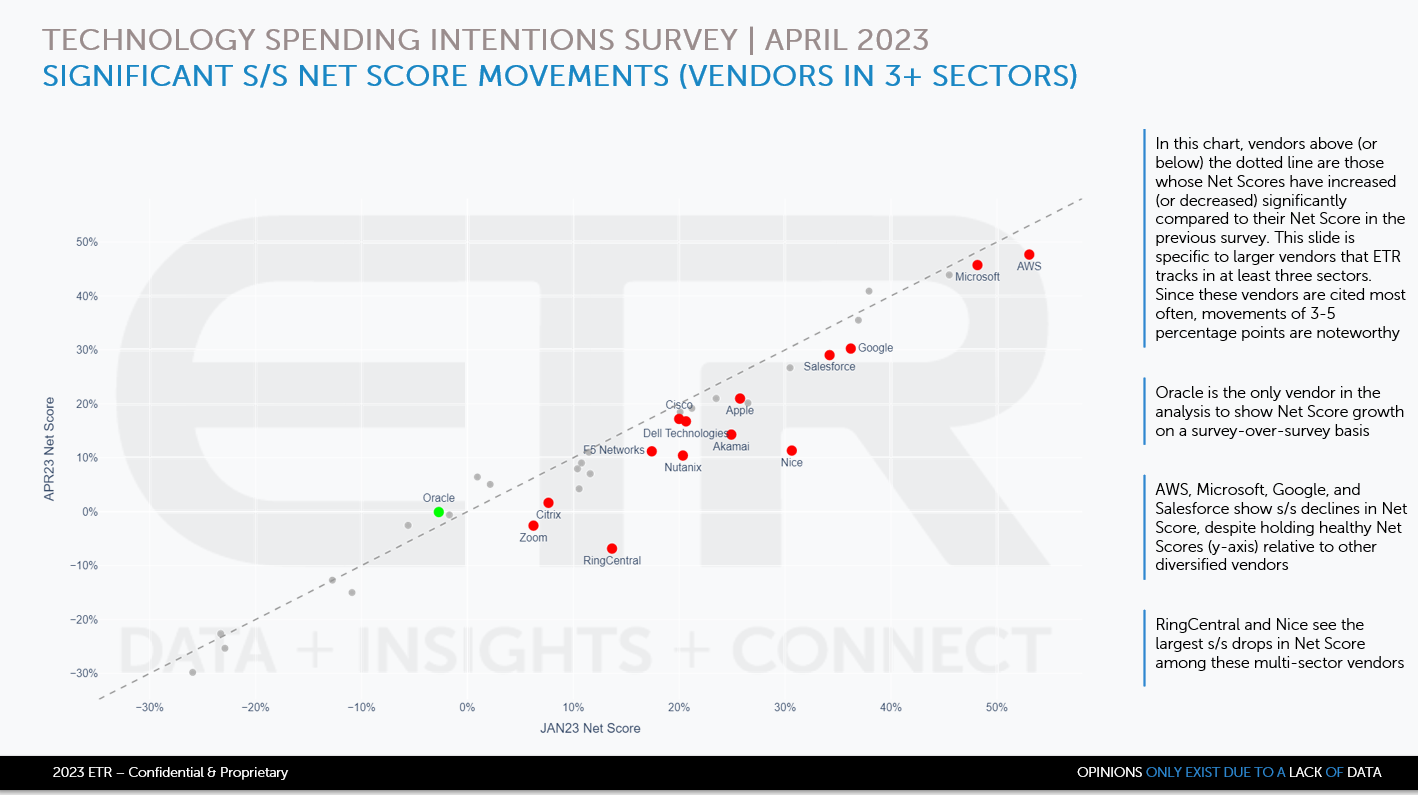

Last week's Part 1 detailed sector and vendor level movements, where the data captured a notable s/s decline in spending intentions across several sectors for the third consecutive survey. In fact, no sector showed a significant increase in Net Score on a survey-over-survey basis. This week we get one level deeper and see that among larger, platform-type vendors tracked in 3 or more ETR sectors, Oracle is the only vendor in the analysis to show Net Score growth on a survey-over-survey basis. AWS, Microsoft, Google, and Salesforce show s/s declines in Net Score, despite holding healthy Net Scores relative to other diversified vendors. RingCentral and Dropbox see the largest s/s drop in Net Score among these multi-sector vendors. (see data visualization below).

Among vendors tracked within one or two ETR sectors, higher volatility in Net Score movement is expected compared to vendors with more diversified product portfolios. In this survey, only three vendors (C3.ai, Paylocity, and SAS) showed Net Score growth vs. January 2023. High Net Score vendors seeing significant declines s/s include Databricks, ServiceNow, and Genesys. The largest Net Score declines s/s include Genesys, SUSE, Intuit, and Polycom, along with Smartsheet, MariaDB, Capgemini, and Constant Contact.

Moving on to Pervasion rates within the April 2023 TSIS survey period, Adobe (Productivity Apps, ECM), Microsoft (Servers, IP Telephony), and SAP (Enterprise Apps, Infrastructure Software) captured the largest s/s citation growth.

Among lower citation vendors, many Enterprise Apps vendors are seeing strong citation growth, including Sprinklr, Medallia, Paycom, CloudSense, Sage, LivePerson, OneStream, Paylocity, and BlackLine.

Lastly, loyal readers will recognize that this next data slide is a repeat of last week's Part I article; however, it is worthy of repetition. One of the numerous benefits of having a global ITDM community is our ability to gather data and analyze events in real time, and this next slide is just one example of that prowess. Given recent bank failures, ETR quickly analyzed which enterprise technology companies in our coverage universe have the highest exposure to the Financials/Insurance vertical within our survey respondent community. Splunk is not only most exposed to Financials/Insurance sector respondents but also captures the largest y/y and s/s declines. Cloudflare is the only other vendor seeing both a y/y and s/s Net Score decline in this analysis. On the other end of the spectrum, both Proofpoint and Workday have high leverage in the sector but are capturing y/y, and s/s increases in their respective Net Scores.

Ok, that wraps up our early takeaways report, but next week, we kick off our webinar series with the April 2023 Macro Views Findings Webinar and then follow up with the full April 2023 TSIS Findings Webinar on Friday, April 21st. During this busy period for the ETR Research team, we will take a brief hiatus from our weekly newsletters, but in the meantime, you can reach out to the ETR team at service@etr.ai to register for the webinars. Not a member yet; let's fix that right now with our one-click, no strings attached free trial.

Until next time, the ETR family wishes a very happy Passover and Easter for all that observe.

Thank you for being a part of the ETR Community; we are truly grateful for your continued participation and support.

Enterprise Technology Research (ETR) is a technology market research firm that leverages proprietary data from our targeted IT decision maker (ITDM) community to provide actionable insights about spending intentions and industry trends. Since 2010, we have worked diligently at achieving one goal: eliminating the need for opinions in enterprise research, which are often formed from incomplete, biased, and statistically insignificant data. Our community of ITDMs represents $1+ trillion in annual IT spend and is positioned to provide best-in-class customer/evaluator perspectives. ETR’s proprietary data and insights from this community empower institutional investors, technology companies, and ITDMs to navigate the complex enterprise technology landscape amid an expanding marketplace. Discover what ETR can do for you at www.etr.ai